stock option sale tax calculator

Use the employee stock option calculator to estimate the after-tax value of non-qualified stock options before cashing them in. If you receive an option to buy stock as payment for your services you may have income when you receive the option when you exercise the.

Locating And Discovering Sales Tax Medical Icon Sales Tax Tax

Please enter your option information below to see your potential savings.

. This calculator can be used to estimate the potential future value of stock options granted by your employer. On this page is an Incentive Stock Options or ISO calculator. Understanding Your Stock Option Benefits.

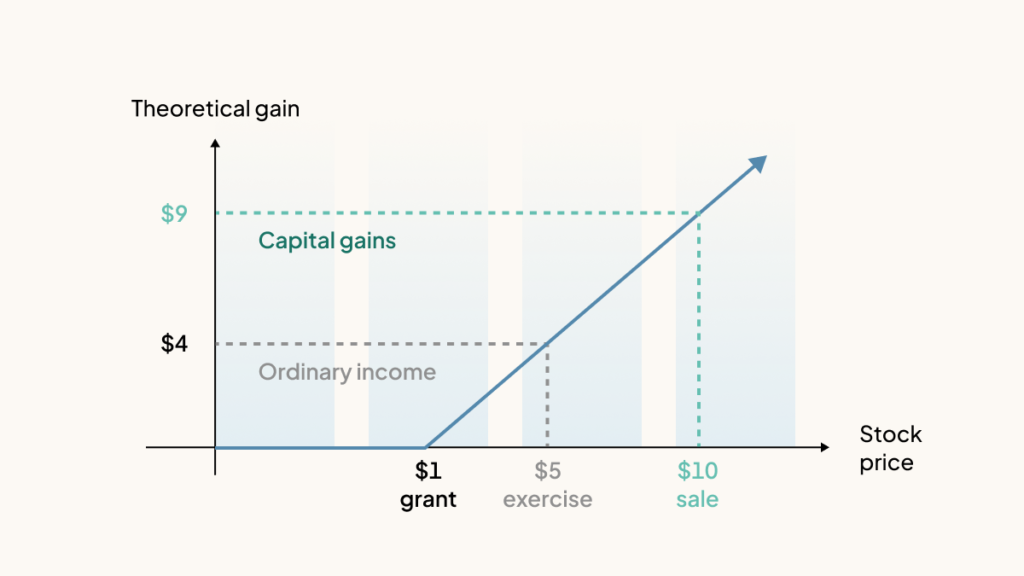

Non-qualified Stock Option Inputs. 60 of the gain or loss is taxed at the long-term capital tax rates. Your source for the latest on options and the most innovative companies to invest in.

The calculator requires a total of five inputs including. Ad For Private and Public Companies Who Want Equity Plans Done Right. Ad Wendy Kirklands investing Course shows how to earn extra income trading options.

This calculator illustrates the tax benefits of exercising your stock options before IPO. 40 of the gain or loss is taxed at the short-term capital tax rates. Section 1256 options are always taxed as follows.

Ad For Private and Public Companies Who Want Equity Plans Done Right. You make a 147 pre-tax gain on each ISO you sell 150 3 strike price For each sold ISO you owe 6615 in ordinary taxes 147 45 Your net gain is 8085 per ISO. The following table shows an example of how much stock option values would be at various growth levels for an employee who annually obtained.

React fast to market moving headlines and economic announcements day and night. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. Click to follow the link and save it to your Favorites so.

New Tax Laws Recently there has. How much are your stock options worth. Ad Hedge portfolio generate alpha or express a directional view on volatility.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. Enter the number of shares purchased. This calculator lets you estimate how much it will cost you to exercise your options or will help you compute the gain in a given exercise and sale scenario.

A long-term capital gains tax calculator calculates the tax on the profit from the sale of an asset according to your taxable income and your marital status. The Stock Option Plan specifies the employees or class of employees eligible to receive options. This permalink creates a unique url for this online calculator with your saved information.

Ad Get a Great Start for Managing Futures w a Free Guide from ADMIS. Ad Gain access to the Nasdaq-100 Index at 1100th the notional value. Find out the 1 mistake investors make when starting to trade options.

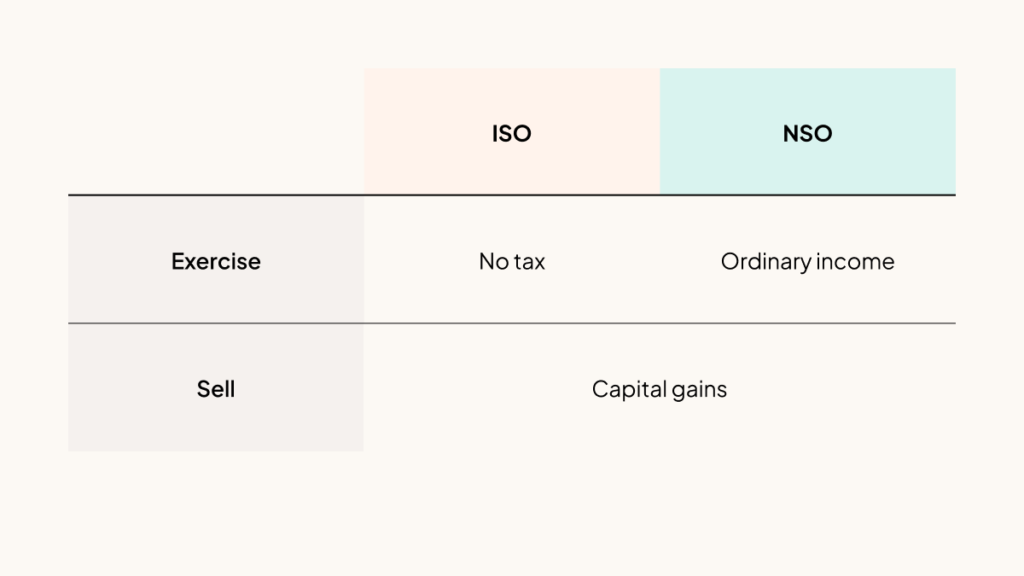

There are two types of stock options. The Stock Option Plan specifies the total number of shares in the option pool. Options granted under an employee stock purchase plan or an incentive stock option iso plan are statutory stock options.

The current stock price. Build Your Future With a Firm that has 85 Years of Investment Experience. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

NSO Tax Occasion 1 - At Exercise. The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term capital gains compared with a maximum rate of 37.

How Stock Options Are Taxed Carta

Craft Show Profits Checker And Organizer Pricing Templates Excel Spreadsheets Templates Excel Spreadsheets

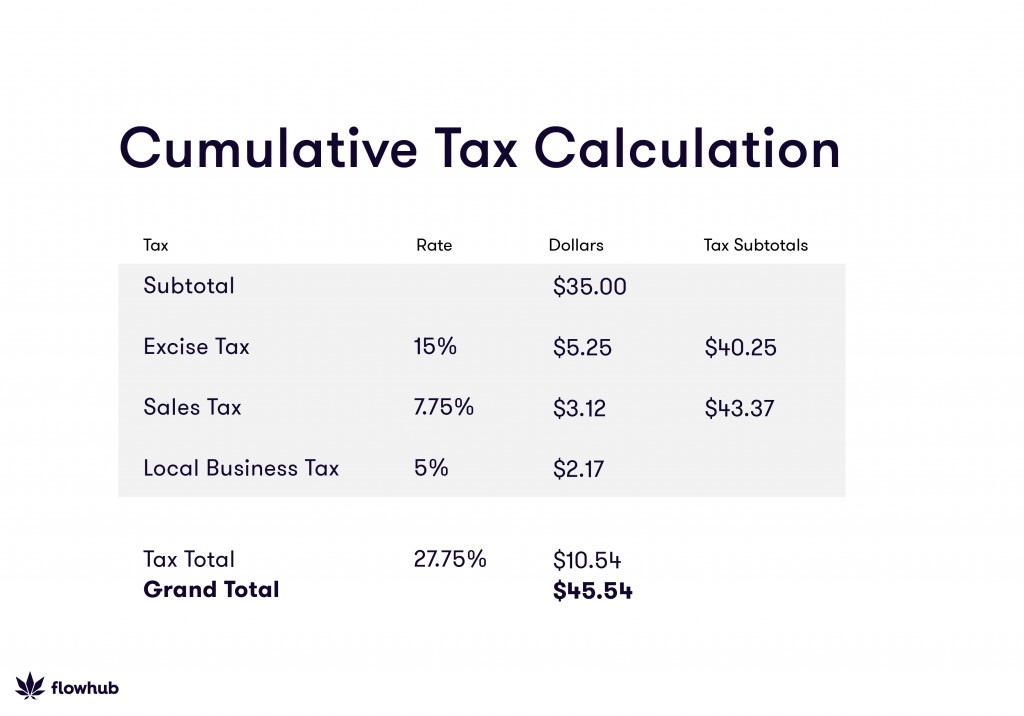

How To Calculate Cannabis Taxes At Your Dispensary

A Visual Guide To Employee Ownership Employee Stock Ownership Plan Journey Mapping Selling A Business

End Of Year Inventory Template Calculate Beginning And Ending Inventory Excel Worksheet Excel Spreadsheets Templates Pricing Templates Types Of Taxes

1031 Exchange How Do Sales Costs Of Dst S Compare With Traditi Investing Corporate Bonds Selling Real Estate

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Tax Checklist

How To Calculate Cannabis Taxes At Your Dispensary

Reverse Sales Tax Calculator 100 Free Calculators Io

Yes You Can Go Through The Home Purchase Process Without Being Physically Prese Home Buying Process Mortgage Tips Home Buying Checklist

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Tax Rates Gordon County Government

Arizona Sales Tax Small Business Guide Truic

Federal Income Tax Calculator Atlantic Union Bank

Need Help And Taxes Text On Stickers With Tax Forms Assistance With Filing Tax Form And Calculation In 2022 Filing Taxes Income Tax Preparation Tax Preparation

How Stock Options Are Taxed Carta

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com